AI Agents for Banking and Financial Institutions

AI Agents Engineered to Transform Financial Services and Boost Customer Success

AI Agents Engineered to Transform Financial Services and Boost Customer Success

RESOURCES

AI Agents for Banking, Financial Services & Insurance

A Smarter Approach to BFSI Success

Supervity Partners with the Largest Commercial Banks to Enhance Customer Experience with Gen AI Agent

What Are AI Agents? Key Features, Benefits, and Industry Applications

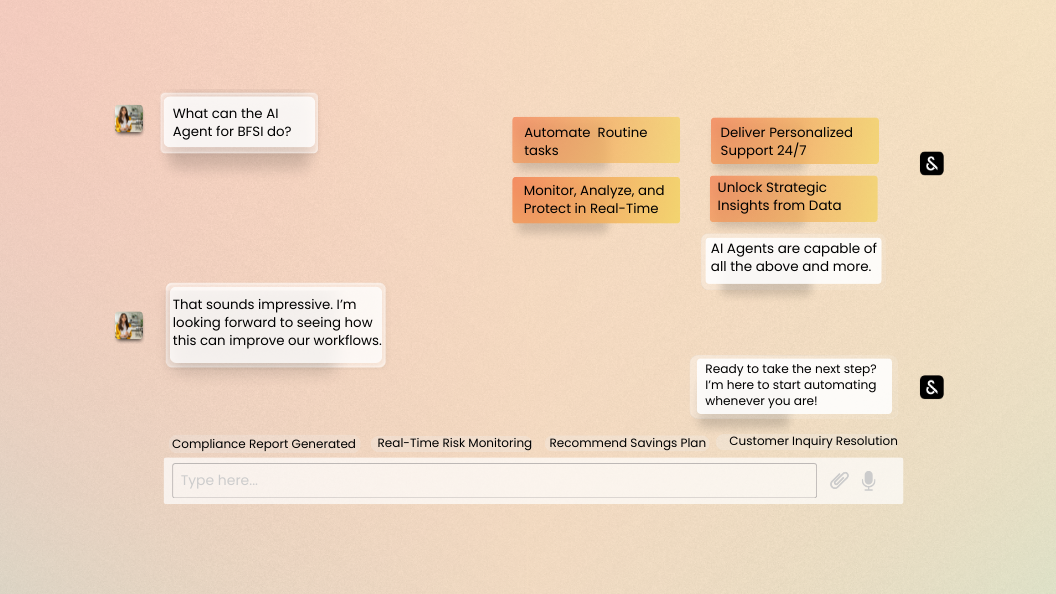

AI Agents are intelligent systems ...

AI Agents personalize advice, automate resolutions, and provide 24/7 support across various channels, fostering satisfaction and loyalty.

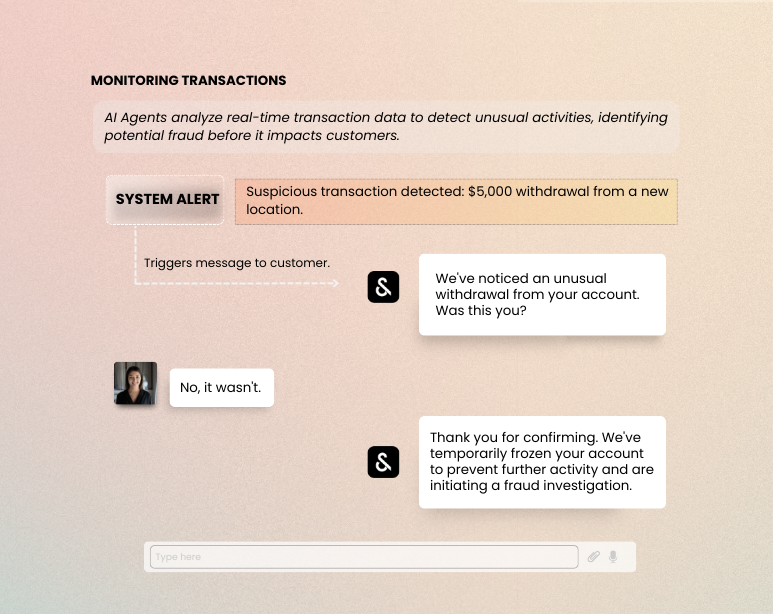

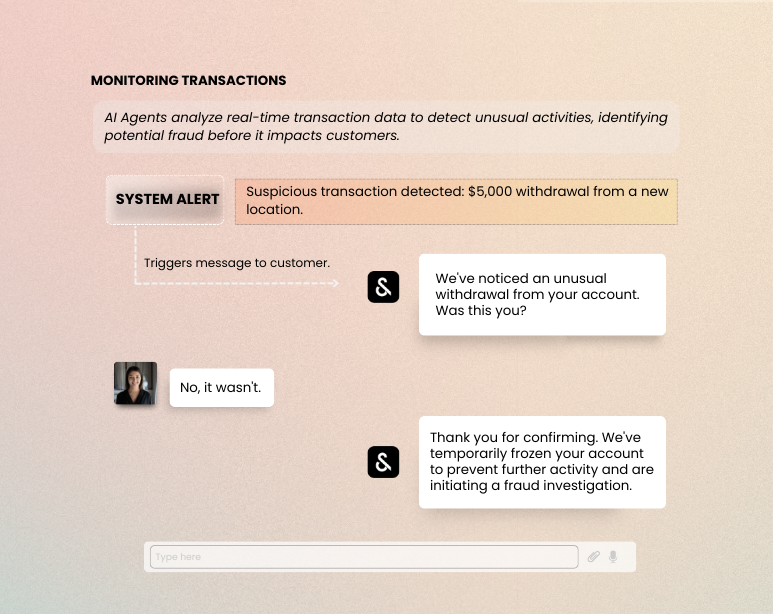

AI Agents monitor transactions in real-time, detect fraud, and ensure regulatory compliance. They provide risk assessments and simplify compliance through automated processes.

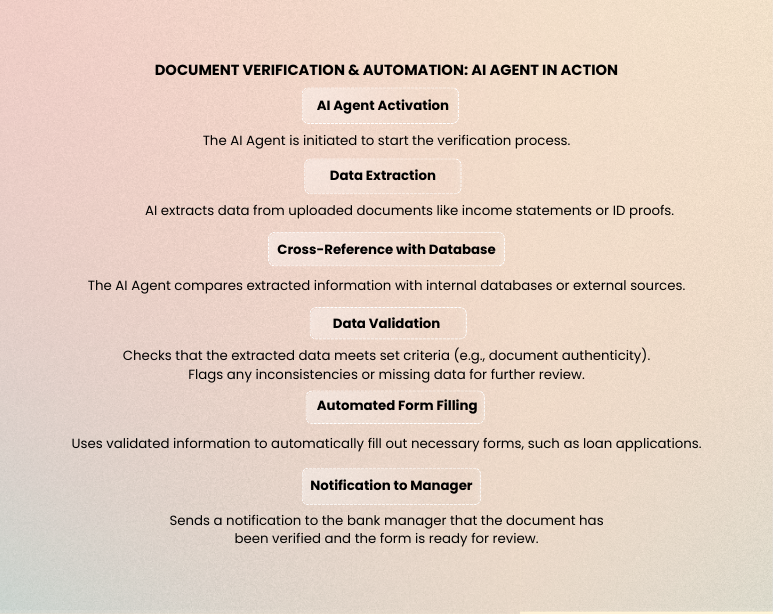

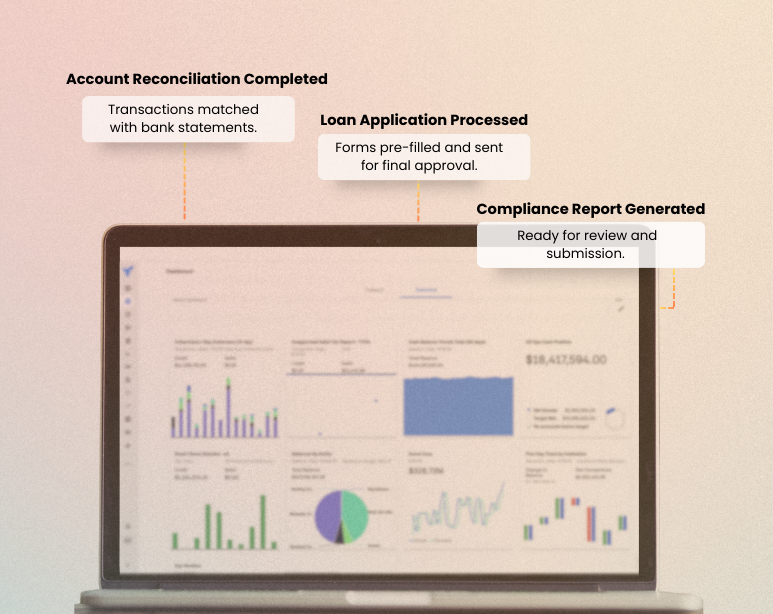

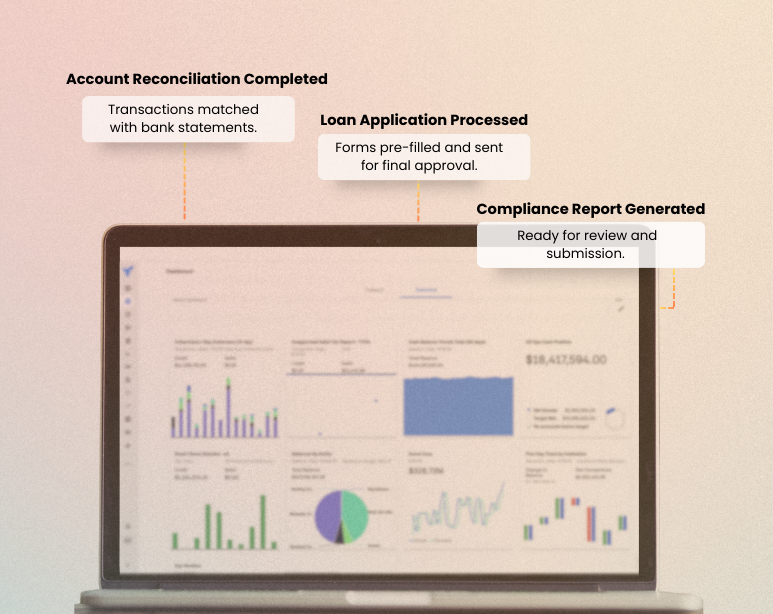

Automates core banking tasks like account reconciliation and loan approvals, reducing errors and speeding up processes, resulting in smoother workflows and faster turnaround times.

AI Agents handle essential functions like account reconciliation, loan processing, and compliance reporting, minimizing manual effort and errors.

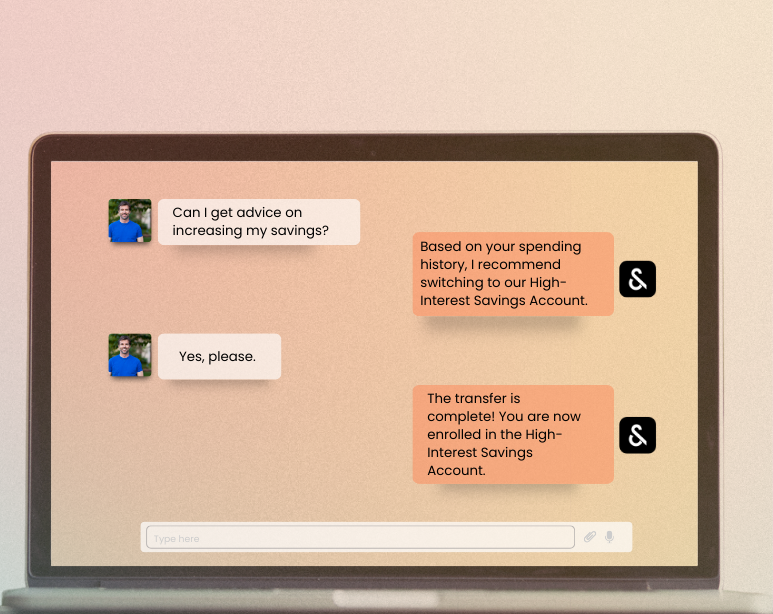

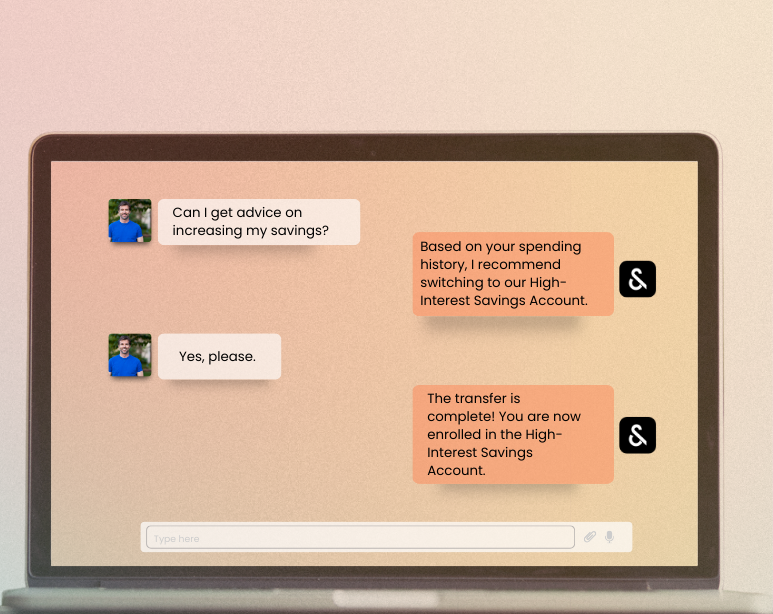

Provide personalized financial guidance, automate responses to common queries, and offer around-the-clock assistance to create seamless customer experiences.

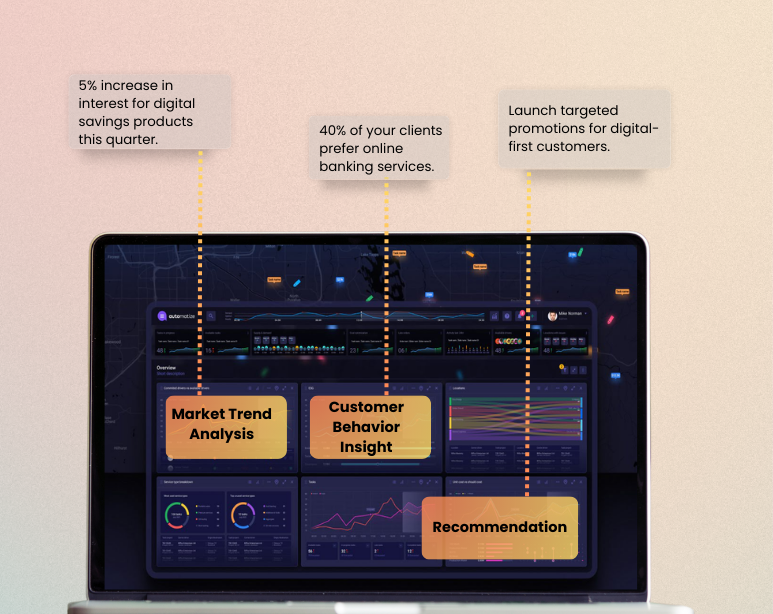

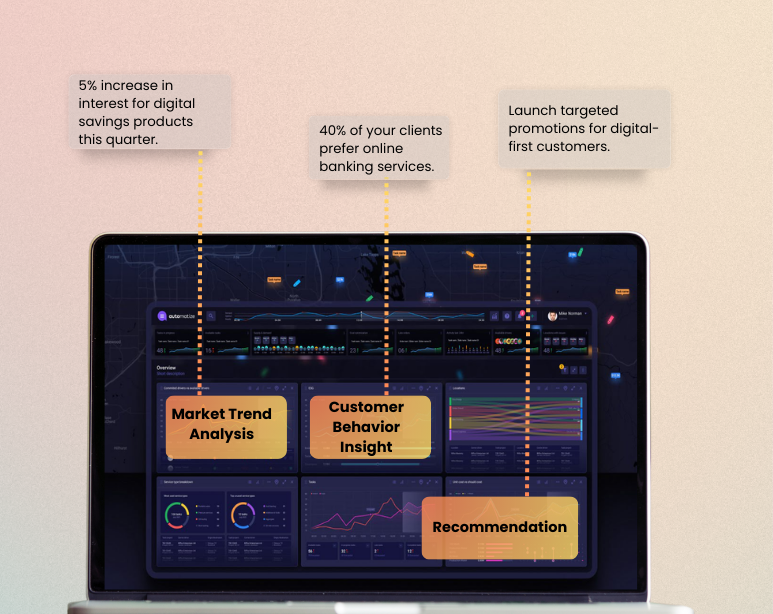

AI Agents assess transactions and market trends, detecting anomalies and assessing credit risks in real-time for effective risk management.

AI-powered analytics uncover insights into market movements, customer behavior, and operational trends, supporting strategic decision-making.

Experience a more efficient, AI-driven approach to banking, investing, and insurance operations.

AI Agents automate routine financial tasks like transaction processing, account reconciliation, and compliance reporting, allowing financial professionals to focus on high-value activities.

By leveraging AI-powered chatbots and intelligent routing, customer queries are resolved more quickly, enhancing satisfaction and loyalty.

AI Agents analyze customer data to provide personalized product recommendations, boosting cross-selling opportunities and revenue growth.

AI Agents are designed to seamlessly integrate with your existing systems. The implementation process is swift, allowing you to start automating workflows and improving operational efficiency within days. Depending on your specific setup and customization needs, the integration process can be completed without disrupting day-to-day operations.

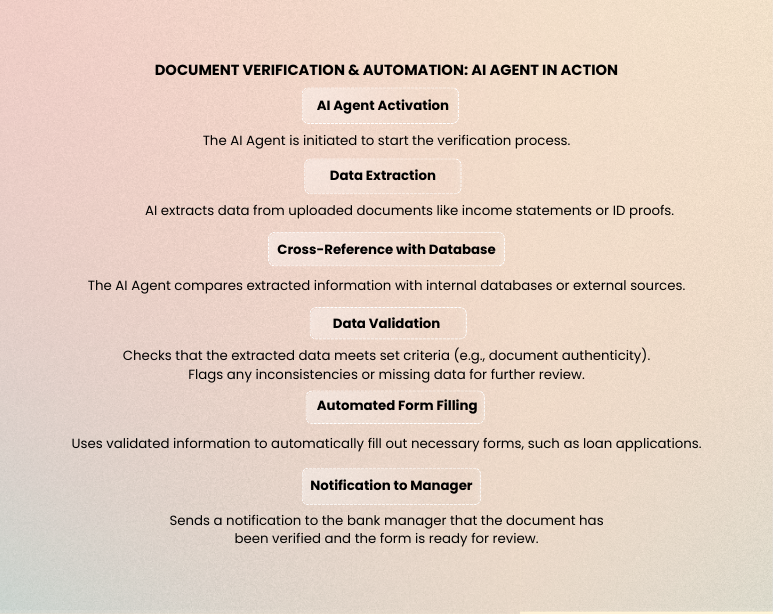

AI Agents can automate a wide range of routine tasks, including account reconciliation, loan processing, compliance reporting, and transaction processing. They reduce the need for manual intervention, allowing your employees to focus on higher-value tasks while minimizing errors and speeding up overall workflows.

AI Agents continuously monitor transactions and market activities in real-time, automatically flagging suspicious activities and assessing risk. They adhere to regulatory standards by generating compliance reports and maintaining an audit trail, ensuring your institution remains compliant with financial regulations while proactively mitigating fraud.

Yes, AI Agents provide 24/7 personalized customer support by analyzing customer data and offering tailored financial advice. They can handle common inquiries, automate transactions, and recommend products or services based on individual customer profiles. This level of personalization enhances customer satisfaction and loyalty, providing faster, more accurate support at any time.